vermont income tax refund

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff 802 828-2505 Department Directory.

Where S My Refund Vermont H R Block

Then click Search to find your refund.

. Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund. Box 1881 Montpelier Vermont 05601-1881. W-4VT Employees Withholding Allowance Certificate.

The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. For returns filed by paper. As much as we would like to help TurboTax does not distribute refunds only the IRS or your state tax agency can legally.

For the state EITC Vermonters must first claim the credit on their federal return and then complete the 2011 Vermont income tax return and Schedule IN-112. Where to Mail Tax Filings and Amendments. May 17 Vermont Personal Income Tax and Homestead Declaration Due Date.

However if you owe Taxes and dont pay on time you. Taxes may not be required if the property is being left to a surviving spouse. If you still have questions about your state tax refund contact the Vermont Department of Taxes Individual Income Tax Division.

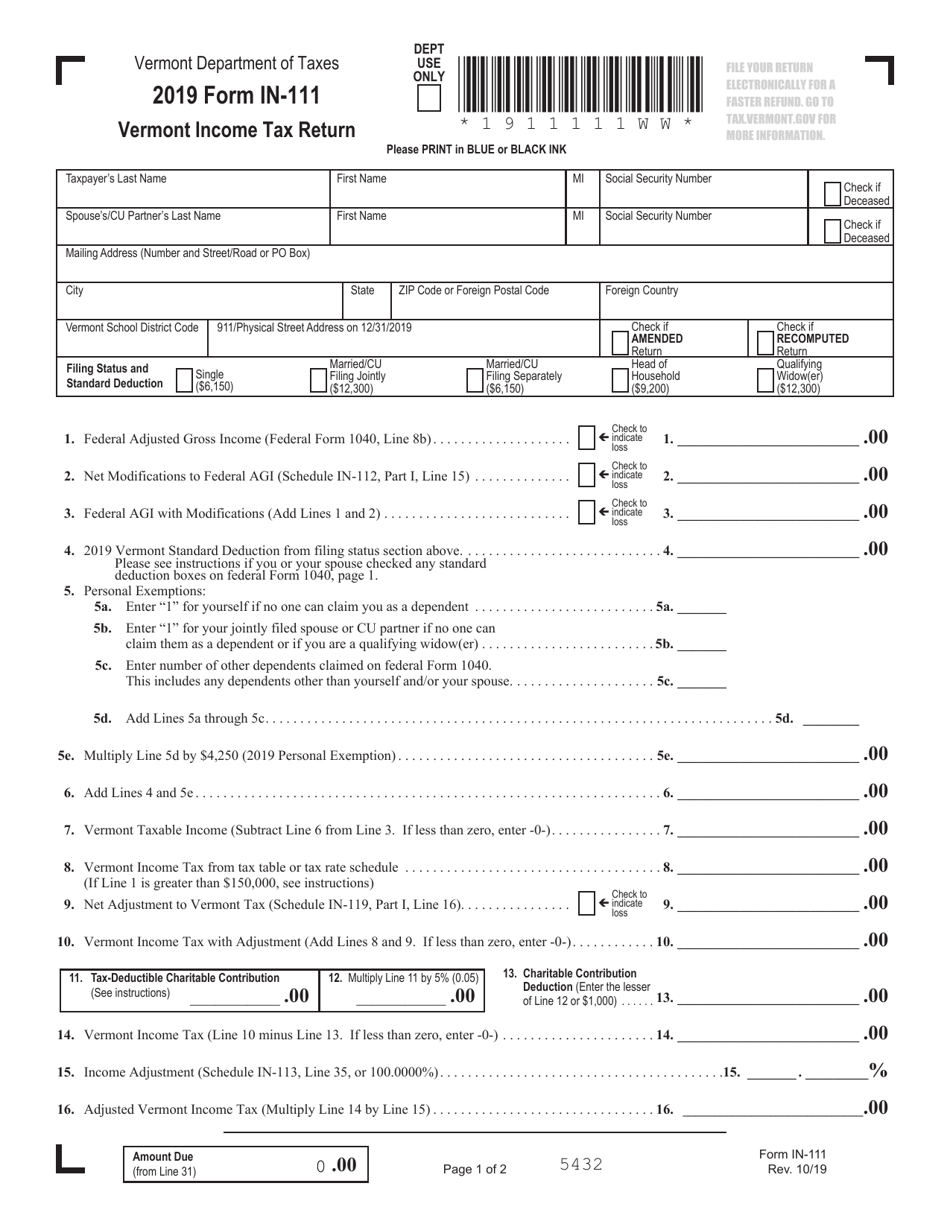

IN-111 Vermont Income Tax Return. If you cant file your Vermont income tax return by April 15 you can apply for a six-month extension through myVTax online or by mailing Form IN-151 Application for Extension of Time to File. A state estate tax return is required.

If you used direct deposit check with your bank for deposit information. Call the Vermont Department of Taxes at 802 828-2865. If we cannot process your form we consider your tax return not filed which may result in late fees and penalties.

Property Tax Bill Overview. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. If you are due a refund or dont owe any tax mail your return to Vermont Department of Taxes PO.

Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. Of Vermont but you earned more than 1000 from a source or sources in the state and you are required to file a federal income tax return then you must also file a Vermont tax return. Vermont State Tax Refund Status Information.

This form is only used for the income tax return and does not extend the filing of any Homestead Declaration or Property Tax Adjustment Claim. You can mail an income tax amendment. Ad The Leading Online Publisher of National and State-specific Legal Documents.

A Vermont extension can be requested with Vermont Form IN-151 by April 18 2022File 2021 Vermont Prior Year Taxes. The process time for e. Department of the Treasury.

Pay Estimated Income Tax Online. Vermont Department of Taxes Issues Refunds to Unemployment Benefit Recipients. If you owe taxes attach a check to your form and mail it to Department of Taxes at the following address.

Find out when your Vermont Income Tax Refund will arrive. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. The tax department says refunds will be sent to those who received benefits last year and electronically filed their 2020 Vermont individual income tax returns prior to the federal unemployment.

If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty. Vermonts EITC state law allows a resident to receive a tax credit of 32 percent of the amount the taxpayer receives from the federal EITC. Like many other states Vermonts state income tax is progressive.

Click on Check the Status of Your Return Personal Income Tax Return Status. Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. See How Long It Could Take Your 2021 State Tax Refund.

Checks can be cashed up to 180 days after the issue date. Ad Learn How Long It Could Take Your 2021 State Tax Refund. Please wait at least three days before checking the status of your return on electronically filed returns and six to eight weeks for paper-filed returns.

How to Check Your Vermont Tax Refund Status Check your VT refund status on their website. Pay Estimated Income Tax Online. To check the status of your return you should wait at least 72 hours for an electronically filed return and four or more weeks for paper filings.

Check For The Latest Updates And Resources Throughout The Tax Season. And you ARE ENCLOSING A PAYMENT then use this address. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. Its top rate however is. Pay Estimated Income Tax by Voucher.

Vermont State Tax Refund Status Information. Vermont Income Taxes. Jan 17 2022 MONTPELIER The 2022 tax season officially opens January 24 at both the federal.

Kansas City MO 64999-0002. Rates range from 335 to 875. Extensions - A 6-month extension is available to extend the filing of a Vermont income tax return by filing Form IN-151 - Application for Extension of Time to File Form IN-111.

Vermont State Income Tax Return forms for Tax Year 2021 Jan. PA-1 Special Power of Attorney. Checks can be cashed up to 180 days after the issue date.

If you dont owe taxes or are expecting a Vermont tax refund you will need to use the address. Taxvermontgov You can help us speed up the processing of your return and refund by following these tips. 866 828-2865 toll-free in Vermont Email.

Pay Estimated Income Tax by Voucher. Any estates worth more than the 5 million cut. Property Tax Bill Overview.

Allow up to 8 weeks for processing time. Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund.

Vermont Income Tax Vt State Tax Calculator Community Tax

Individuals Department Of Taxes

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Personal Income Tax Department Of Taxes

Vermont Tax Forms And Instructions For 2021 Form In 111

Paying Taxes Is On Everyone S Mind Rarely In A Good Way Knowing Some Pithy Facts About Our Tax Syste How To Create Infographics Surprising Facts Paying Taxes

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Complete And E File Your 2021 2022 Vermont State Tax Return

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Vermont Income Tax Vt State Tax Calculator Community Tax